Enhanced

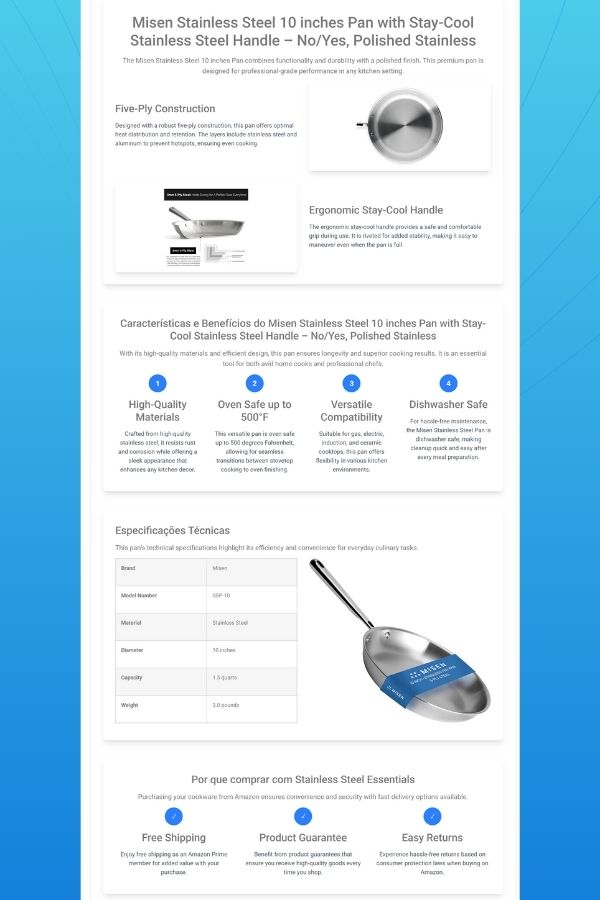

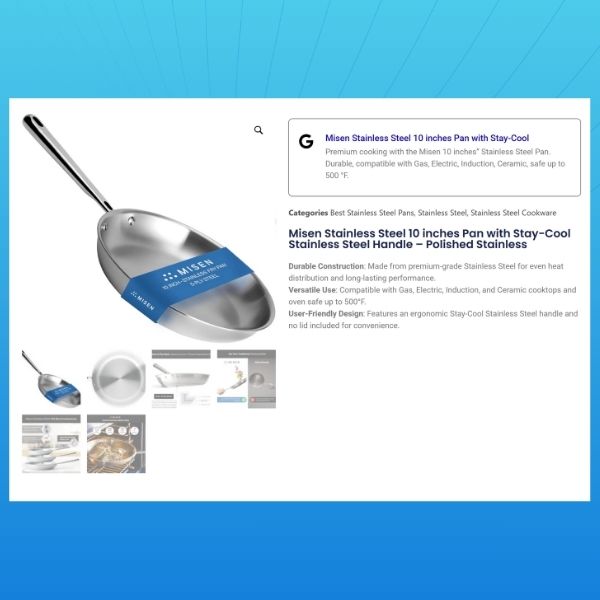

Product Pages

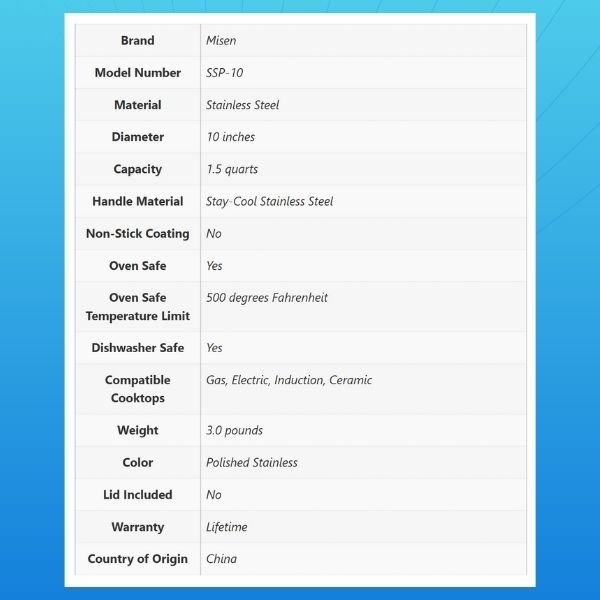

Template system deliver consistent, SEO-optimized product pages that improve indexing, and conversion rates.

Get Started For Free

Test our tools today and see the difference.

Product Enrichment

AI Tools

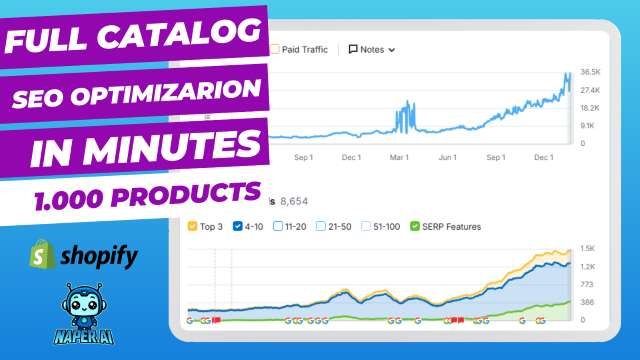

Add SEO to Catalog Pages in minutes

Experience faster indexing and drive more traffic with AI-powered optimization tool.

Shopify Products

and Collections Strategy

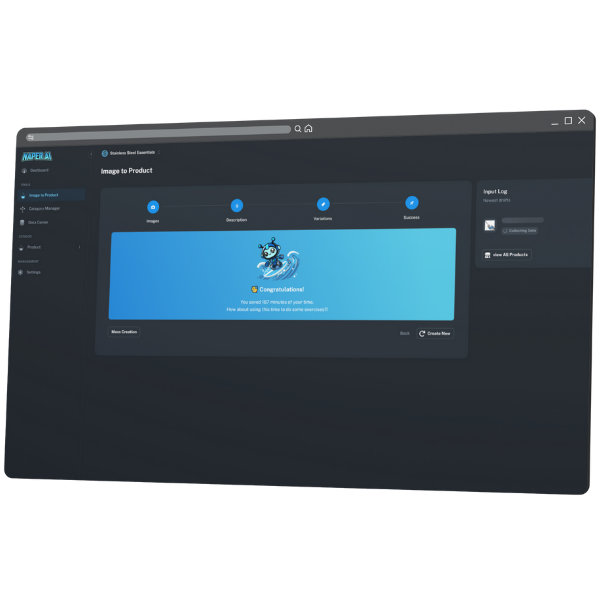

Create Collections with AI

Use the Category Tree Generator to build Collections with AI and Google data.

Categorize Products Efficiently

Assign products to Collections via Data Center for streamlined SEO.

Enrich for Maximum Impact

Bulk enrich Collections and Products using standardized SEO templates with AI.

Export and Rank on Google

Export your catalog to Shopify and boost your Google rankings.

Compatible with Shopify,

ecommerce and marketplaces

Get Started For Free

Test our tools today and see the difference.

How We Turned Keywords

into Revenue Machines!

We helped brands dominate search results with AI.

Turn keywords into profits with smarter SEO strategies.

These success stories prove the power of AI for ecommerce growth.

Achieved 2,000 keywords on Google’s first page.

Improved organic visibility with AI-driven product listings and category optimization.

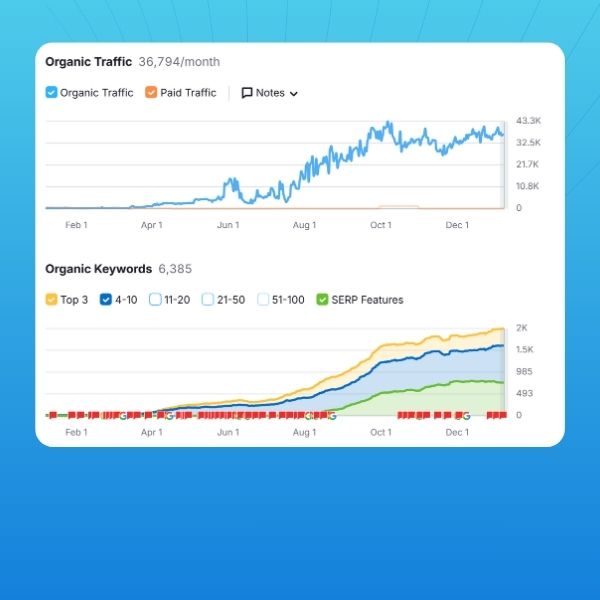

Grew from 160 to 2,200 keywords on Google’s first page.

Achieved top search rankings with advanced product and category optimization tools.

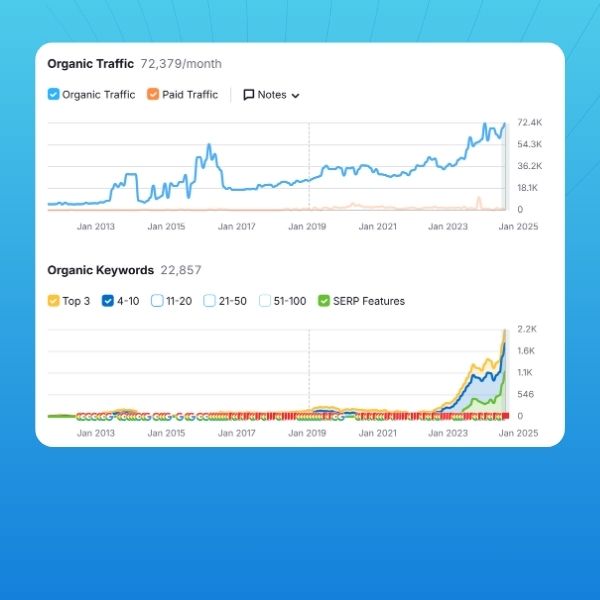

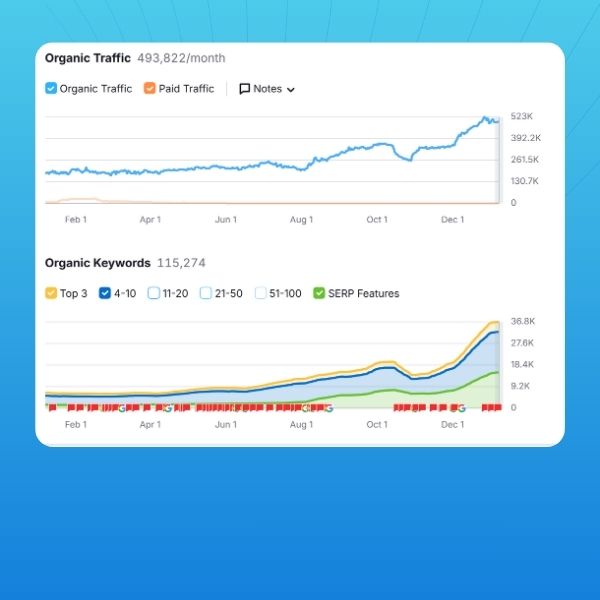

Jumped from 6,000 to 37,000 keywords on Google’s first page.

Leveraged AI-powered enrichment to dominate search rankings and boost traffic.

How much Naper AI cost?

Naper.ai plans include monthly AI Credits for your ecommerce tasks.

Enrich a field for 1 credit, a product listing for 5 credits, or generate a category tree for 5 credits.

Save more with annual plans and buy extra credits anytime.

6.000 AI Credits / year

($0.05 each extra credits)

60.000 AI Credits / year

($0.05 each extra credits)

Shopify SEO Experts

Enterprise Services

Schedule a call to discover our services.

SEO For Ecommerce

Grow your e-commerce visibility.

Catalog Enrichment

Scale your catalog refinement.

Product Listings and Ecommerce SEO

Increase Organic Traffic (SEO)

Enhance visibility and attract more visitors.

Improve Conversion Rates

Turn more visitors into customers.

Drive Sales and Revenue

Grow your business with optimized listings.

Product Management

Simplify catalog updates and reduce errors.

Enhance Product Discovery

Make products easier to find and buy.

Scale Effortlessly

Expand your store without extra effort.